What is Initial DEX Offering (IDO)

The evolution of the cryptocurrency industry as a whole has led to this crowdfunding technique, one of several innovative methods of launching a project.

TL;DR:

The ability to fund crypto initiatives early in a fair, safe, and generally embraced manner is critical to the project's success.

The initial coin offering (ICO) was the first crypto project fundraising. While it had numerous advantages, it was also responsible for creating a bubble because it was vulnerable to dump schemes.

IEO was the second edition, which addressed most of the concerns associated with ICOs while introducing a sour taste of centralization.

IDO addressed the flaws within the system and is the most recent and up-to-date method of supporting crypto native initiatives. While it is far from flawless (as is the case with most things in Web3), it has taken notes from prior versions and is the most stable method we have at the moment.

Today we are going to be taking on an essential concept within the realm of crypto space. As we have briefly covered IDO and other most popular token sales models in a previous article, we will be analyzing what flaws IDOs addressed in their inception along with their advantages compared to the alternatives. Fundraising is a critical step in any potential successful project, and it is usually the first and most crucial step that a team behind a particular project will undertake to maximize the chance of realizing their vision. Investing in innovative projects at their earliest stage through these initial offering mechanisms is a high-risk, high-reward move; let’s establish that with a concrete example:

Solana’s 1180x ATH ROI

Solana’s public Initial Coin Offering (ICO) was back in March of 2020, in which SOL tokens were priced at $ 0.22. At the time of writing this article, Solana is currently priced at around $40. This means those who invested in the project at that stage currently have around 188.79x (+18,848.8%) returns on their investment (ROI). At the height of the 2021 bull run, investors would have an all-time high return of 1180.1x (+117,910%) on their investments. If you were to put $100 down on it at the ICO, you would currently have $19k and at the peak, you would have had $118k, crazy right? (Source)

Now that we have solid intuition on the importance of initial offering mechanisms, we may now proceed with today’s topic. Before we take a deep dive into Initial DEX Offering (IDO) we need to take a look at the evolutionary steps that led to this type of fundraising model.

In the Beginning, There was the ICO

ICO, or an “Initial Coin Offering”, was the first iteration that came in and went out with a bang, being the funding approach that many companies took in what’s now called the ICO bubble.

ICO is very similar to a traditional business IPO (Initial Public Offering), where instead of shares from a company, a crypto project would issue tokens (coins) that would be up for sale and distribution among the early participants in a project.

The benefit of an ICO is that it’s a very frictionless way of creating starting capital. There are no dependencies on strong legal bindings and/or intermediaries. The tokens are directly issued by the founding team and made available for direct purchase.

With the above benefits in mind, this technique allows teams to swiftly bootstrap and start constructing products by allowing them to get capital into the business immediately, allowing them to pay for development, marketing, and any other expenditures associated with getting the project off the ground. The tokens would be distributed in a variety of ways depending on the initiatives. It would likely begin with a “closed sale,” in which project insiders may purchase tokens at a discounted price.

However, this creates a potentially dangerous situation, as early buyers will be able to sell tokens they purchased at a lower price for a greater price once the open sale (for the whole public) begins. This means that, depending on the incentives, a token dump might flood the market and dramatically lower the price, benefiting those who “dumped” the tokens in the first place while monetarily punishing the project’s early and most emotionally committed participants.

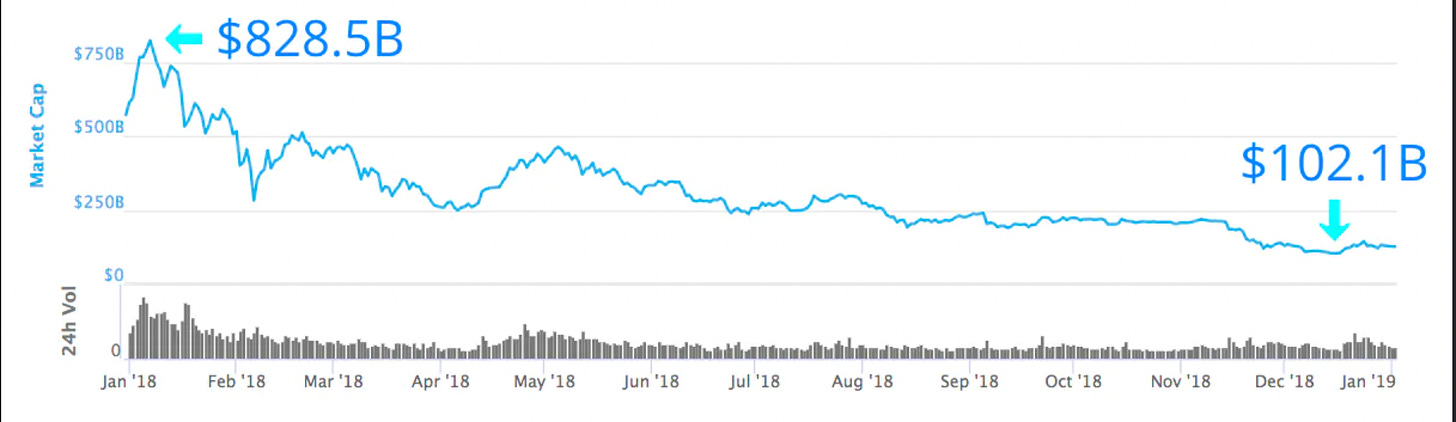

These aspects of the ICO strategy sparked the 2018/2019 ICO bubble, which prompted the evolution and requirement for a new and better crypto project financing approach.

The Transition to IEO

Whereas ICOs allowed for a “quick and dirty,” almost rogue-like approach to project funding, IEO, or “Initial Exchange Offering,” was the next generation of project finance. A project’s tokens would be listed on an official exchange and then traded by the exchange’s users in an exchange offer.

Many of the concerns with the ICO approach were resolved by having an established platform in place to handle the sale. The exchange would be a legal company with tighter legal ties, providing a sense of security to potential token purchasers. It would also “vouch” for the project’s legitimacy.

The IEO corrected the ICO bubble by overlaying a more organized legal framework on top of the process, but it increased friction in use, as it does with most legally expanded procedures.

Only users who have registered for that exchange, for example, would be allowed to join, narrowing the pool of prospective participants and hence limiting the amount that a project may raise.

Another factor that irritated crypto enthusiasts was that a centralized entity was suddenly participating (and crucial) in what was supposed to be a decentralized movement. After all, all initiatives were built on encrypted and decentralized protocols with the specific objective of countering centralization and the concentration of power in a single entity in mind.

Then came along the IDO

By the time more crypto startups hit the scene, a crucial instrument of the crypto ecosystem, decentralized exchanges, or DEXs, had emerged. They were a counter to centralized exchanges that would govern the flow, buying, selling, and trading of crypto coins/tokens on a particular blockchain using smart contracts. A DEX is a pre-programmed piece of software that runs on a blockchain in the form of a smart contract and serves as the interface between projects that want to sell their tokens and those that want to buy those tokens and join the protocol. In contrast to a centralized exchange, a DEX may be accessible by anybody with a wallet that is compatible with the blockchain on which the DEX is based, rather than requiring the creation of a detailed personal account on a centralized exchange.

Even while this limits the number of individuals who may participate in IDOs because they must be crypto-literate (know how to set up a wallet, etc. ), it is good news for crypto advocates because it allows users to have more freedom while being secure in a decentralized manner. Because of its decentralized structure, regulatory frameworks would be easier to design, making it easier to implement ‘en masse’ in the future

An IDO can be described as a compromise between the speed of an ICO but the chaotic potential of an IEO and the security but centralization of an IEO.

While the crypto/Web3 infrastructure is still being built out, and we don’t know if or what the next iteration of methods for crypto project funding will be, we can at least infer that it will be based on a decentralized approach. While decentralized, this future solution’s qualities would most likely include being easily accessible, safe, and scam/dump-proof.

Where it lacks incentive

IDOs are the newest model for crypto projects looking to raise funds from investors. But they’re not without their limitations. For instance, DEXs are less scalable. It’s not uncommon for ICOs and IEOs to be able to raise more than $1 billion. For DEXs, this is unheard of.

Because DeFi platforms come with a steep learning curve, a lack of knowledge regarding how crypto works may act as a barrier to entry for the average crypto trader. Countering this challenge efficiently would require funding education in DeFi.

Evolution Never Ends

As with most things in life that are ever-dynamic and ever-changing, innovation comes through disruptive ideas and dedicated man-hours. Is this the final form of fundraising mechanism within this realm? Probably not, and that’s the beauty of it all, there is no traditional, outdated, and fixed form of doing things in Web3. The greatest idea takes the cake. OpenPad aims to take a slice of this pie by offering a capital-efficient and fair way to launch and invest in tomorrow’s projects today. To learn what OpenPad brings to the table and why to choose us, check out our article here.

Resources to Learn & Invest with OpenPad

🕸 Home: openpad.app

📖 Docs: docs.openpad.app

🧢 Twitter: twitter.com/OpenPadCitizens

📒 Web3 Newsletter: openpad.substack.com

🔗 Official Links: linktr.ee/openpad